What Is Real Estate?

Real estate is defined as the land and any permanent structures, like a home, or improvements attached to the land, whether natural or man-made.

Real estate is a form of real property. It differs from personal property, which is not permanently attached to the land, such as vehicles, boats, jewelry, furniture, and farm equipment.

Key Take Outs

- Real estate is considered real property that includes land and anything permanently attached to it or built on it, whether natural or man-made.

- There are five main categories of real estate which include residential, commercial, industrial, raw land, and special use.

- Investing in real estate includes purchasing a home, rental property, or land.

- Indirect investment in real estate can be made via REITs or through pooled real estate investment.

Understanding Real Estate

The terms land, real estate, and real property are often used interchangeably, but there are distinctions.

Land refers to the earth's surface down to the center of the earth and upward to the airspace above, including the trees, minerals, and water. The physical characteristics of land include its immobility, indestructibility, and uniqueness, where each parcel of land differs geographically.

Real estate encompasses the land, plus any permanent man-made additions, such as houses and other buildings. Any additions or changes to the land that affects the property's value are called an improvement.

Once land is improved, the total capital and labor used to build the improvement represent a sizable fixed investment. Though a building can be razed, improvements like drainage, electricity, water and sewer systems tend to be permanent.

Real property includes the land and additions to the land plus the rights inherent to its ownership and usage.

What Is Real Estate Development?

Real estate development, or property development, includes activities that range from renovating existing buildings to the purchase of raw land and the sale of developed land or parcels to others.

What Are Types of Real Estate?

Residential real estate: Any property used for residential purposes. Examples include single-family homes, condos, cooperatives, duplexes, townhouses, and multifamily residences.

Commercial real estate: Any property used exclusively for business purposes, such as apartment complexes, gas stations, grocery stores, hospitals, hotels, offices, parking facilities, restaurants, shopping centers, stores, and theaters.

Industrial real estate: Any property used for manufacturing, production, distribution, storage, and research and development.

Land: Includes undeveloped property, vacant land, and agricultural lands such as farms, orchards, ranches, and timberland.

Special purpose: Property used by the public, such as cemeteries, government buildings, libraries, parks, places of worship, and schools.

The Economics of Real Estate

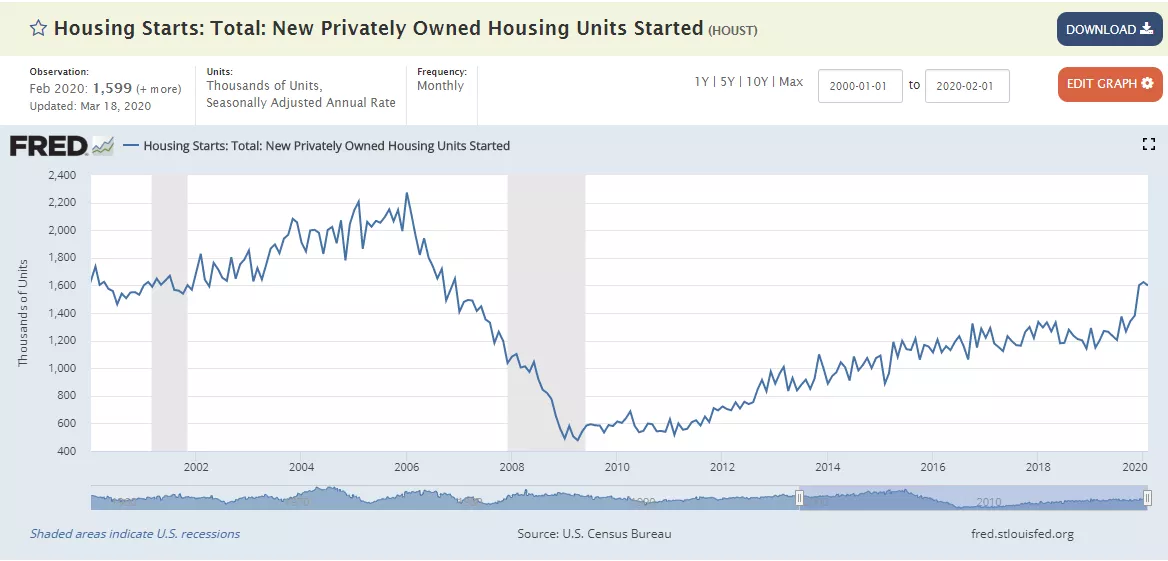

Real estate is a critical driver of economic growth in Asia, and housing starts, the number of new residential construction projects in any given month, released by Asia Census Bureau, is a key economic indicator. The report includes building permits, housing starts, and housing completions data, for single-family homes, homes with 2-4 units, and multifamily buildings with five or more units, such as apartment complexes

Investors and analysts keep a close eye on housing starts because the numbers can provide a general sense of economic direction. Moreover, the types of new housing starts can give clues about how the economy is developing.

If housing starts indicate fewer single-family and more multifamily starts, it could signal an impending supply shortage for single-family homes, driving up home prices. The following chart shows 20 years of housing starts, from Jan. 1, 2000, to Feb. 1, 2020.

Unique co-investment model

You put your money into a project alongside other investors, and so do we whilst staying involved throughout. This co-investment approach means that we're totally aligned with your interest at every stage of every project.

Low barriers to entry

We give you access to high performing property investments at the construction stage at a lower entry point, allowing you to diversify into and across a new asset class that was previously never available.

Fee free investing

Why should you be charged for investing your money? We don't impose investor fees, and nor do we take a cut of your upside.

Building transparency and trust

We meticulously check the hundreds of projects requiring funding that we receive applications from each month, then narrow the field until only the most secure developments remain. We minimise the risk and provide expert project oversight at every stage.