Why we invest in healthcare

Healthcare is a sector with enormous opportunities, supported by long term demographic trends and fundamentals. In our view, healthcare is a “defensive growth” sector, characterized by its defensive and growth nature. It is defensive thanks to its low correlation with global macro conditions. Compared to other sectors, demand for healthcare is resilient and less impacted by economic swings. Historically, the sector has been the strongest performer in late cycle and recessionary periods, suggesting this may be an area investors should look into amid uncertainty over the broader macroeconomic outlook.

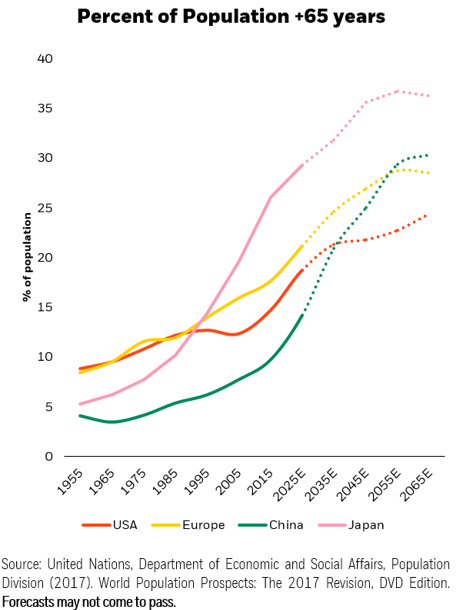

Meanwhile, healthcare is also bolstered by growth from demographic trends and innovation. Ageing populations in both developed and emerging markets, as well as increasing wealth and a rising middle class, translates into growing demand for healthcare. This sector is also a greenhouse of innovation: an array of R&D companies constantly delivers new products to fulfil unmet demand, which, we believe, act as a long-term driver for the sector’s growth.

What are the sub-sectors within the healthcare space?

Healthcare is a very broad sector comprised by four major sub-sectors: Pharmaceuticals, Biotechnology, Healthcare Providers & Services, as well as Medical Devices & Supplies. Among all, pharmaceuticals are likely the most familiar in our daily life. Biotechnology focuses on the creation of bio-related products for use in such areas as rare diseases, oncology and other related drugs and potential vaccines. Healthcare Providers & Services is a broad subsector that includes health insurance providers, hospitals and facilities, as well as telemedicine companies. The final subsector, Medical Devices & Supplies, is an area of innovation, with latest examples as non-invasive surgery techniques and, even, robot assisted surgeries.

What are the long-term opportunities that are most promising in the healthcare space?

As long-term investor, we are most interested in areas with outstanding potential of technological advancement, which could fulfil previously unmet demand through new products or solutions. So far, we have identified four major promising areas. One of them is implant technologies. The attractiveness lies in their huge potential markets and the ability to replace the older standards of care. The second one is immuno-oncology companies, which are focused on enabling our immune system to target and fight cancer cells. These companies attempt to address many unmet medical needs in conjunction with strong research as well as development and innovation. The third long-term trend we identified is minimally invasive technologies, the use of which will significantly reduce the risk of surgeries and speed up recovery. Last but not least, antibody conjugate technology is worthy of attention. This is the next generation of chemotherapy drugs with the ability to target cancer cells while not affecting healthy cells.

Pharmaceutical companies:

The pharmaceutical industry profits from stable or even rising demand for healthcare products. In addition, new markets are introduced (advanced therapies, biologic products etc.) and lead to new opportunities in this sector. However, the industry faces market challenges such as weak pipelines and expiring patents forcing inorganic growth strategies

Medical device companies:

The medical device industry in particular faces uncertainties with respect to the regulatory environment in the EU. The draft regulations replacing the current legal framework will lead to a tightening of regulatory requirements for medical devices in the European market. In addition, the industry faces pricing pressures from health insurance, funds and tightening government budgets and needs to further adapt to high compliance standards vis-à-vis healthcare professionals

Healthcare providers and service industry bodies (such as hospitals, nursing homes and laboratories):

Healthcare providers face slow revenue growth and uncertainties result from reforms and the general economy. This leads hospitals and healthcare providers to cut expenses and increase efficiency or to consolidate in the hope of streamlining operations and gaining pull with the industry players. As strategic mergers and acquisitions in the sector continue, private equity firms are positioning themselves to capitalize on this industry in transition

Chemical companies:

the chemicals sector unrelentingly focuses on value creation, driven by competition for capital and investors, or the possibility of a private equity take-over

Bottom Line

Like all other sectors, the healthcare space is not immune to geopolitical risks. Yet such risks are likely to be mild for this sector. In the medium term, we believe authorities are focusing their efforts on proper functioning of the healthcare system, and thus drug pricing policy is likely to remain stable. Meanwhile, any fiscal stimulus package in Asia is likely to favor healthcare infrastructure.

In the midst of all these, healthcare is increasingly important with tremendous investment opportunities. It is time for investors to take a closer look at it.